About VAT

VAT on ticket prices

In most cases, if you are a registered VAT payer, you sell tickets with VAT included.

Fienta uses the VAT rate from your billing settings, found under “Settings” > “Billing settings”, and assumes that the ticket prices you enter include VAT.

Displaying VAT rate on the checkout page

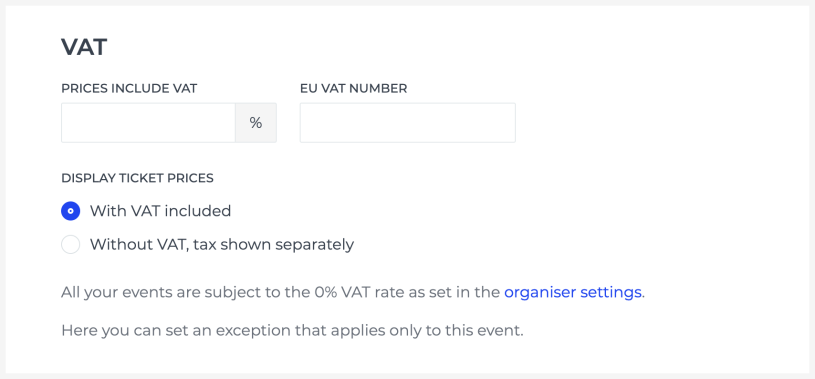

By default, we display prices to buyers with VAT included. If you'd prefer to show prices without VAT, you can enable this setting in your event's "Advanced settings". When this option is turned on, buyers will see net prices, and VAT will be added and shown separately at checkout.

Special VAT cases

In some situations, you may need to apply a different VAT rate to specific events or even to specific ticket types. For example, in certain countries, the VAT rates for conference entry fees and accommodation differ.

Alternate VAT details per event

If you are registered as a VAT payer in multiple countries and need to use a different VAT rate and VAT number for a specific event instead of the ones in your billing settings, you can set this under the event’s "Advanced settings".

Specific VAT for ticket types

If only some ticket types require a different VAT rate, please contact us – we can set it up for you.

VAT on Fienta's fee

24% VAT applies to our service fee for companies registered in the European Union (EU) without a valid VAT number, and when billing private individuals.

Customers based in Estonia are always subject to VAT.

VAT does not apply to companies within the EU that have a valid VAT number, or to companies and private individuals based outside the EU.

VAT on Fienta’s fee applies only to our service charges, not to the ticket prices you sell to your customers.